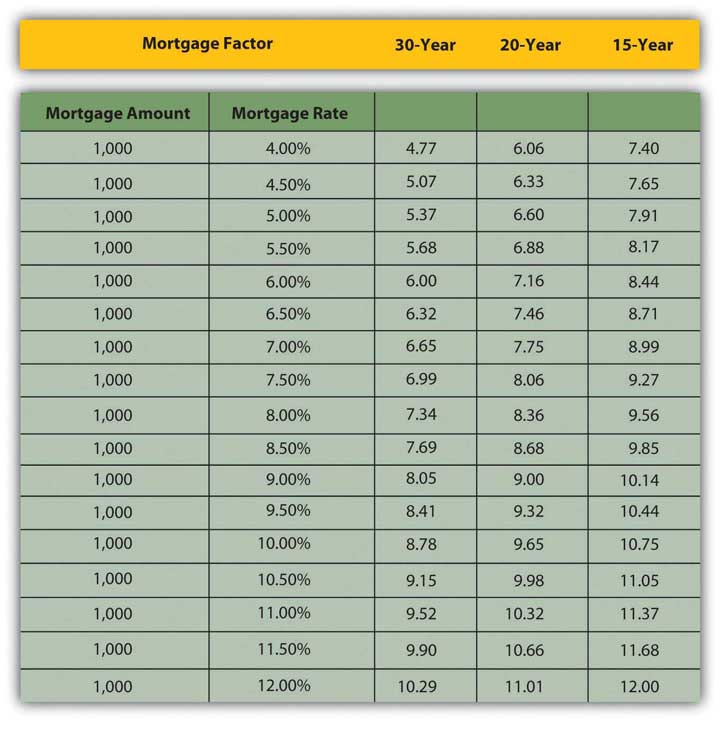

Mortgage payment per 1000 borrowed

Make a lump sum payment of up to 15 of the original principal amount borrowed. 1050 APR 999 APR.

How Much A 1 000 000 Mortgage Will Cost You Credible

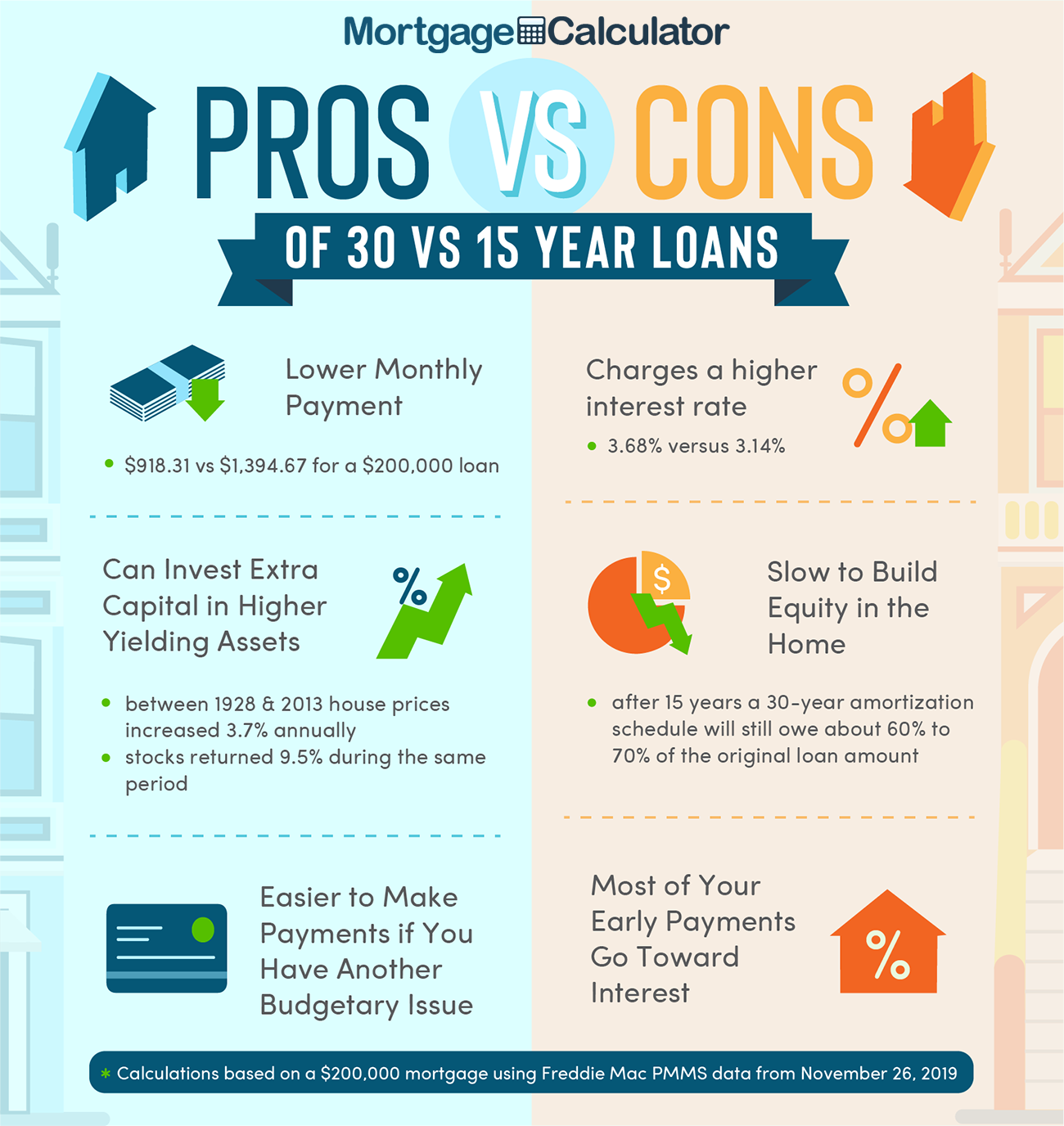

Refinancing is not the only way to decrease the term of your mortgage.

. Fees Vat rough averages 12 Mortgage value Old law. LTV ratio measures the value of your loan. Payments do not include taxes and insurance and actual payment may be greater.

Payments on a 15 year loan at 574 APR would be 830month for 180 months per 1000 borrowed. Deed of Mortgage costs. Rate As Low As APR Monthly Payment Example.

Annual or per deposit charges are taken into consideration when calculating costs. Your mortgage principal is the mortgage amount you borrowed to buy your home minus what youve already paid back. The rate indicated for adjustable rate.

Principal interest taxes and insurance. We have a wealth of experience and financing options to make your dream of home ownership possible. Your down paymentIdeally to get the best mortgage interest rates and terms youll want a down payment amounting to 20 of a homes sale price.

Here are several benefits to paying 20 down on your home loan. 15 Year Fixed Rate Loan 30 Day Lock. 2000 down payment due upon acceptance of the Letter of Offer and remainder due on draw down date.

All loans are subject to underwriting approval. By paying extra 50000 per month the loan will be paid off in 14 years and 4 months. Compare loan terms interest rates and costs to get a solid estimate.

Homes for Veterans Program. The TD Mortgage Payment Calculator can help you better understand what your payments may look like when you borrow to buy a home. 1000 saved over 3 years.

Use our Flexible Mortgage Payment Features Calculator to explore your options and try different payment features for managing your mortgage. Though paying a 20 down payment may not be required its still worth making a large down payment on your mortgage. For example if you borrow 200000 to buy a home and you pay off 10000 your principal is.

Decreases your interest rate. Another way of thinking of the first thousand from the full cost per thousand category is that it includes the thousand you borrowed so if you subtracted the first thousand from any of these figures that would represent the portion of spending allocated to interest on the loan. Monthly Payment per 1000 borrowed.

But if you dont have 20 you can put down. The cost of PMI for a conventional home loan averages 058 to 186 of the original loan amount per year. When you make a 20 down the large payment reduces your loan-to-value ratio LTV.

Payment examples do not include amounts for taxes and insurance premiums. The principal is the original amount you borrowed and interest is what mortgage lenders charge for lending you the money. SONYMAs Low Interest Rate Programs 30-Year Mortgage Program Details Without Down Payment Assistance.

3 per 1000 6 tax. If your property taxes cost 1200 per year that would be 100 per month. All in you could pay 1000 per month in taxes and insurance a sizeable bill above and beyond the principal and interest payment.

See School Employee Special No PMI Fixed-Rate Mortgage. If applicable the actual payment obligation will be greater. Your mortgage payment is the amount you pay every month toward your mortgage.

Use our Mortgage Payment Predictor to predict how changes to interest rates will affect the monthly payment and total costs of your mortgage. Monthly payment per 1000 borrowed. Wondering how much youll pay each month and which options to choose.

The above calculations consider the capital and interest portion of the mortgage payment but do not cover other aspects of home ownership. 10-year Fixed 1 points. With Down Payment Assistance.

10-year Fixed 0 points. With a few key details the tool instantly provides you with an estimated monthly payment amount. For example a one-time additional payment of 1000 towards a 200000 30-year loan at 5 interest can pay off the loan four months earlier saving 3420 in interest.

Payments on a 15 year loan at 1004 APR would be 1077month for 180 months per 1000 borrowed. PMI is 05-1 of the loan amount per year PMI is canceled once your mortgage balance reaches 78. Your loan principal is the amount of money you have left to pay on the loan.

Total monthly mortgage payment. Payments on a 10 year loan at 954 APR would be 1296month for 120 months per 1000 borrowed. By paying a little extra on principal each month you will pay off the loan sooner and reduce the term of your loan.

Calculate your mortgage payment. Private Mortgage Insurance PMI is required for down payments less than 20. For instance if you had a 200000 mortgage and 20000 savings offset against it you only pay interest on 180000 of the mortgage.

Your credit score is a number based on information from your credit report. Minimum down payment of 10. Estimated Payment Per 1000 Borrowed 1.

If you typically pay 1000 a month you can increase your payment up to 2000 a month during your mortgage term. This table scales by 18th of a percent from 2 to 10. The most commonly used refer to the original sum of money borrowed in a loan or put into an investment.

For our latest mortgage rates call toll free 18005213796 and ask for our mortgage department. View our Mortgage Rates today. Main Factors That Impact Your Mortgage Loan Price.

3 Monthly Payment Examples assume a loan amount of 100000. For the same 200000 30-year 5 interest loan extra monthly payments of 6 will. Does not take into charges.

After acceptance of Letter of Offer before loan can be disbursed. For example adding 50 each month to your principal payment on the 30-year loan above reduces the term by 3 years and saves you more than 27000 in interest costs. 08 Mortgage value RPO plus Stamp Duty plus Search Title average 1000.

Annual Percentage Rate APR 4875. Adjustable Rate Mortgage rate and payment changes. For non-ISA accounts 20 tax at source is assumed.

Running costs repairs renovations and maintenance The bigger. If you put a 5 down payment on a 350000 30-year loan term you could be paying 161 to 515 a month for PMI. Estimated Payment Per 1000 Borrowed 1.

Some of the monthly payment will have. This calculator figures monthly mortgage payments based on the principal borrowed the length of the loan and the annual interest rate. Loan Amount Points Interest Rate Annual Percentage Rate APR Number of Monthly Payments Payment per 1000 Borrowed.

Similar to the former it can also. Its a payment feature that allows you to use your savings to offset the interest charged on your mortgage. 30 Year Fixed with no points monthly payment example.

Principal is a term that has several financial meanings. Each monthly payment has four major parts.

Current Mortgage Apr Annual Interest Payments Per Thousand Dollars Borrowed Calculator

The Quick Formula To Determine Your House Payment

How Much Does A 300 000 Mortgage Cost And How Can I Get One Fox Business

Current Mortgage Apr Annual Interest Payments Per Thousand Dollars Borrowed Calculator

Current Mortgage Apr Annual Interest Payments Per Thousand Dollars Borrowed Calculator

What Are Interest Rates How Does Interest Work Credit Org

Sky High Ikea Bookcase Ikea Bookshelves Ikea Shelving Unit Ikea Bookcase

If I Pay 5 000 More For The House Of My Dreams How Much Will It Increase My Monthly Payment Parish Lending

15 Year Mortgage Calculator Calculate Local 15 Yr Home Loan Refi Payments Nationwide

/Compoundinterest-f0b145415f244b40bb93c82154e8343d.png)

Qzu4u70r1u 4cm

Mortgage Calculator How Much House Can You Afford

Identify The Financing

Mortgage Calculator Calculate Your Mortgage Payment Forbes Advisor

Payment Factor Table Monthly Mortgage Payments Per 1000

How To Calculate Your Monthly Mortgage Payment Given The Principal Interest Rate Loan Period Youtube

How Much A 100 000 Mortgage Will Cost You Credible

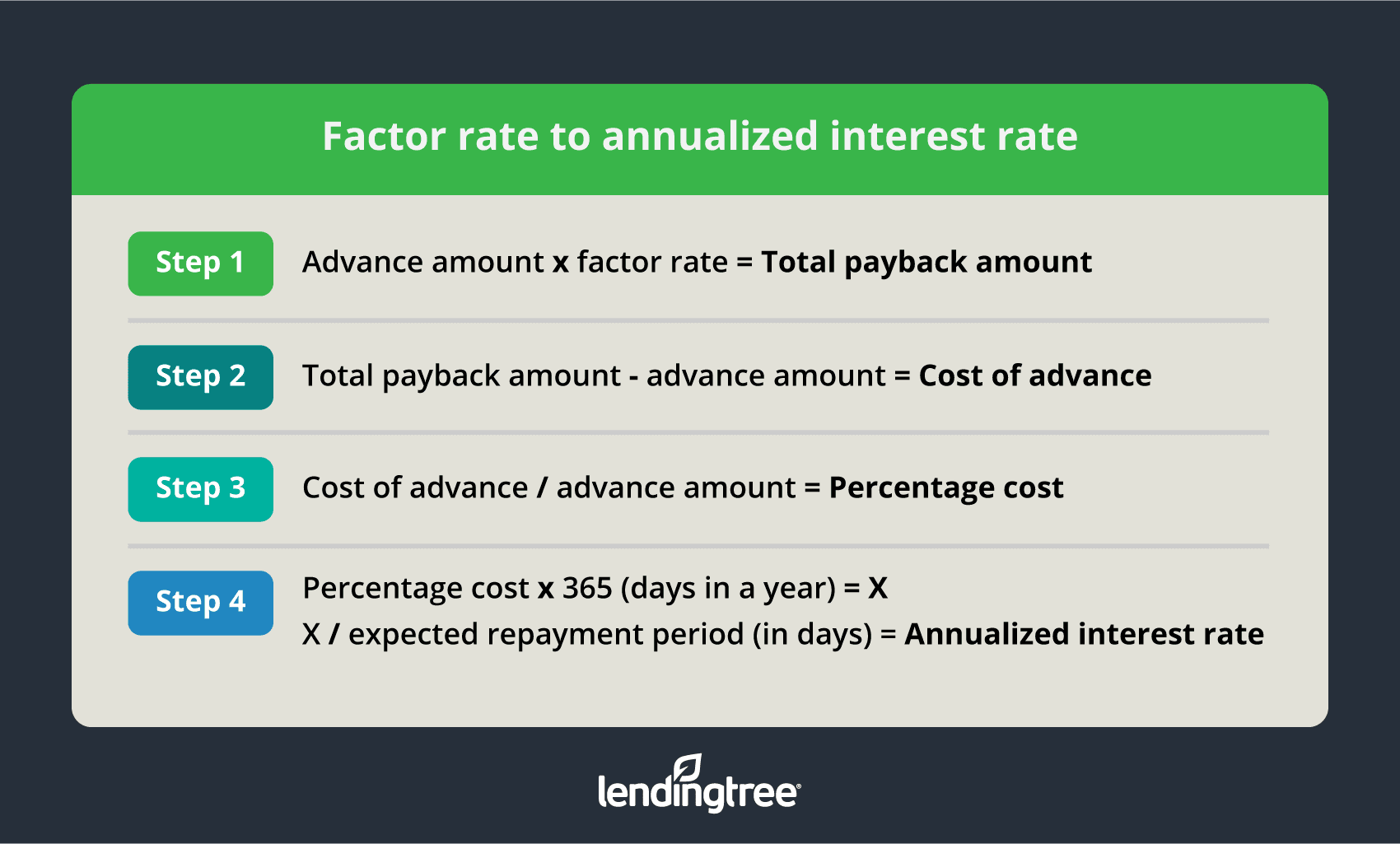

What Is A Factor Rate And How Do You Calculate It